Defence Finance

Defence Housing Entitlements

At Vadium Lending, we recognise the significance of Defence Housing Entitlements for members of the ADF. These entitlements are designed to alleviate the financial burdens associated with service life.

As an ADF member or veteran, you have access to four major tools:

Defence Home Ownership Assistance Scheme (DHOAS)

Home Purchase Assistance Scheme (HPAS)

Home Purchase or Sales Expenses Allowance (HPSEA)

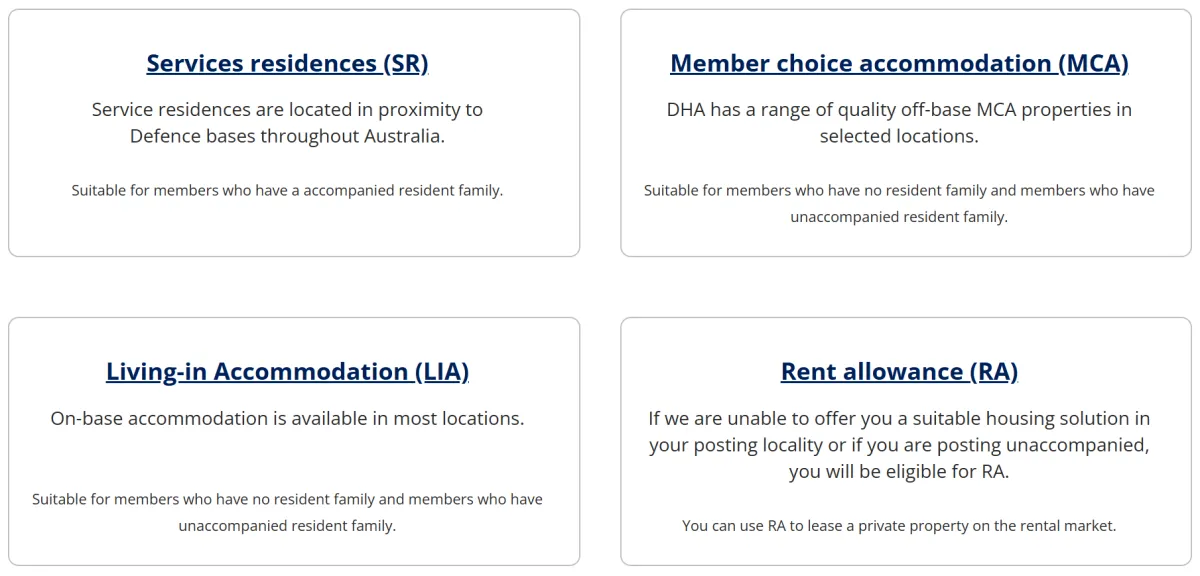

Subsidised Housing (Living-in Accommodation, DHA Housing, Rent Allowance)

Our expertise at Vadium Lending lies in navigating these entitlements across various ADF services and leveraging our wealth of knowledge and experience to provide you with a unique perspective.

By working with us, you can optimise the financial benefits derived from not only these grants but also the federal and state government grants available to you check them out here.

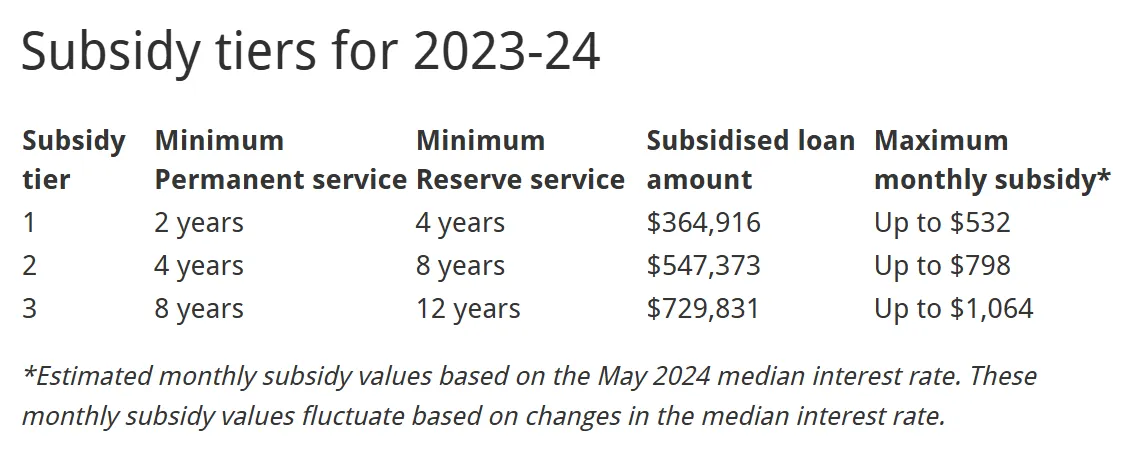

DHOAS Eligibility

To be eligible, you must have served on or after 1 July 2008 and completed a qualifying period of service (minimum of 2 years of consecutive Permanent ADF service or a minimum of 4 years of effective Reserve service of at least 20 paid days per financial year).

You must have completed enough effective service to accrue a service credit

.

HPAS Eligibility

You may be eligible for HPAS if you're a member of the Permanent Forces or a Reserve member on continuous full-time service (CFTS) for at least 12 months and you:

Buy a home in your current or next housing benefit location or family benefit location

Purchase the home after getting your posting order

Will be in that location for at least 12 months after signing the contract

Occupy the home within the required time limit.

The HPAS payment is $16,949 (before tax). If you buy a home with someone who's not resident family, you'll only get a percentage of this amount, depending on what share you own.

You may need to repay HPAS if the purchase doesn't go ahead for any reason.

If Service reasons prevented you from buying the home, you may be able to claim reasonable costs. The ADF Delegations Team can give you more information.

HPSEA Eligibility

You may be eligible to claim reasonable costs if you sell the home in the location you're leaving and:

You or your family live in it

The sale costs are related to your new posting

You previously got HPAS or HPSEA for buying a home

You sign a contract to sell the home within 2 years of getting your posting order to the next location.

You may also get HPSEA for selling a home if your continuous full time service (CFTS) will end in the next 12 months.

Subsidised Housing