Self Managed Super Fund (SMSF) Lending

Our Services, YOUR Options

Leveraging Debt to Achieve Wealth

Residential SMSF

Expand your Residential portfolio and take advantage of tax savings

Investment Residential SMSF Loans

Commercial SMSF

Wanting to obtain a Commercial property, why not hold it in your SMSF

Commercial SMSF Loans

What is a self-managed super fund?

An SMSF is a private super fund that you manage yourself. It can hold assets including shares, term deposits, bonds, and investment properties. It can have up to 6 members.

A successful SMSF can be highly rewarding, but it can also come with greater risk than a regulated super fund. Managing an SMSF also requires some work and it’s important to seek guidance from a trusted financial adviser - and the team at Vadium Lending can get you the assistance you need.

What is an SMSF loan?

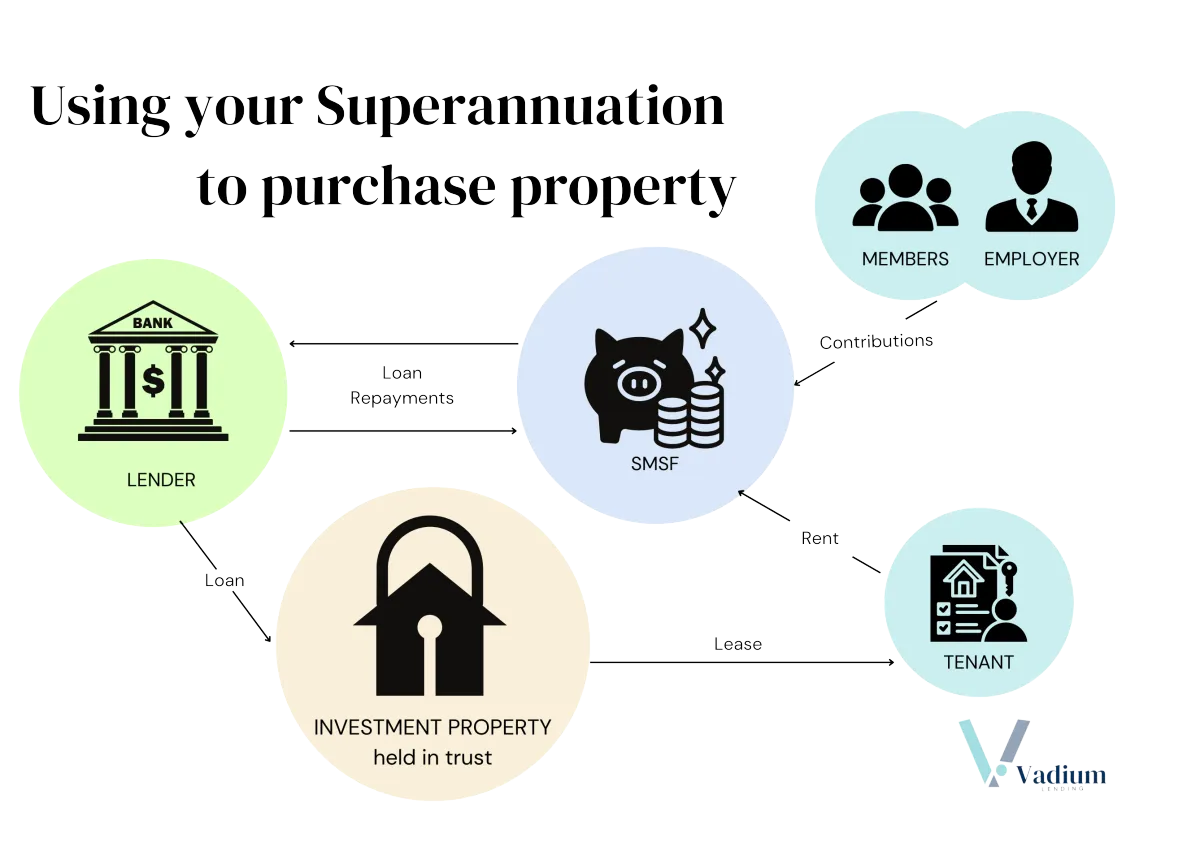

SMSF loans or Limited Recourse Borrowing Arrangements (LRBAs) support SMSF trustees to borrow money to buy an investment property they may not be able to afford to buy through their SMSF outright.

After the purchase, ownership of the property is held in a custodian trust until the loan is repaid. At that point, the SMSF acquires the title. Throughout the life of the loan, SMSF members have a beneficial interest in the property.

Any income generated is reinvested into the SMSF to help repay the loan or increase the value of the fund.

While SMSF loans can be used to buy either commercial property or residential property, it must pass the tax office’s sole purpose test. This means the trustee must be able to prove that the sole purpose of buying the property is to provide retirement income.

How much can I borrow from an SMSF loan?

The amount you can borrow depends on your super fund balance, financial situation as well as your lenders unique policies. Some specialty lenders offer SMSF loans from $100,000 ranging up to $4,000,000 - something that we can tailor to your circumstances, to make sure you are matched with the most suitable lender for your needs!

You might need to maintain a minimum amount within your SMSF after the property sale. This amount will vary depending on your individual circumstances.

How many members can be attached to one SMSF?

You can have up to 6 "members" attached to one Self Managed Super Fund (SMSF).

Can you purchase a house and land package with your SMSF?

Usually no, Lenders will not provide construction loans to your SMSF, but at Vadium Lending we can assist you in obtaining a brand new house and land package through your SMSF, contact us today to discuss further.

What if I don't have much in Super

At Vadium Lending, if you only have a small amount of funds within your superannuation account, we can assist with additional options for you, speak to us today to understand how we can help.

Most SMSF loans have 4 main requirements:

The property must be for the sole purpose of providing retirement benefits or death benefits to SMSF beneficiaries

If residential, the property must not be acquired from a member of the SMSF or any related party of a member

If residential, the property must not be lived in or rented by a member of the SMSF or any related party of a member

The property must not be a single acquirable asset

As you can see in the above, there is a lot to consider. The good news is, we have you covered! Our team will take the stress and the uncertainty out - and put the knowledge and empowerment back into your hands, so that your superannuation does the hard work, so your retirement is palm trees and good times.